| Would giving up meat really help save the planet? Posted: 26 Sep 2019 12:47 PM PDT  With the global population set to explode by 2050, some experts are saying that humans need to reduce the amount of meat they eat to save the planet. Would vegetarianism really curb climate change? With the global population set to explode by 2050, some experts are saying that humans need to reduce the amount of meat they eat to save the planet. Would vegetarianism really curb climate change?

|

| UPDATE 6-Trump considers delisting Chinese firms from U.S. markets -sources Posted: 27 Sep 2019 08:57 AM PDT ![UPDATE 6-Trump considers delisting Chinese firms from U.S. markets -sources UPDATE 6-Trump considers delisting Chinese firms from U.S. markets -sources]() President Donald Trump's administration is considering delisting Chinese companies from U.S. stock exchanges, three sources briefed on the matter said on Friday, in what would be a radical escalation of U.S.-China trade tensions. The move would be part of a broader effort to limit U.S. investment in Chinese companies, two of the sources said. President Donald Trump's administration is considering delisting Chinese companies from U.S. stock exchanges, three sources briefed on the matter said on Friday, in what would be a radical escalation of U.S.-China trade tensions. The move would be part of a broader effort to limit U.S. investment in Chinese companies, two of the sources said.

|

| The Treasury’s Housing Plan Would Pave the Way for Another Financial Crisis Posted: 27 Sep 2019 03:30 AM PDT  Treasury's plan for releasing Fannie Mae and Freddie Mac from their conservatorships is missing only one thing: a good reason for doing it. The dangers the two companies will create for the U.S. economy will far outweigh whatever benefits Treasury sees.Under the plan, Fannie and Freddie will be fully recapitalized — probably by allowing them to keep all or a portion of their profits and by selling shares to the public. However they are recapitalized, Treasury makes clear that they will continue to be backed by the government — a benefit for which they will be required to pay.The Treasury says the purpose of their recapitalization is to protect the taxpayers in the event that the two firms fail again. But that makes little sense. The taxpayers would not have to be protected if the companies were adequately capitalized and operated without government backing.Indeed, it should have been clear by now that government backing for private profit-seeking firms is a clear and present danger to the stability of the U.S. financial system. Government support enables companies to raise virtually unlimited debt while taking financial risks that the market would routinely deny to firms that operate without it.Nor, it seems, has Treasury considered what kind of business Fannie and Freddie will likely pursue as government-backed profit-seeking firms.When Fannie and Freddie had minimal capitalization and a free but "implicit" government guarantee, profitability was easy. Most of the housing finance market was open to them, and they could set their pricing at levels others could not match. That enabled them to drive competitors out of any portion of the market that they wanted to dominate. By the early 2000s they were acquiring and securitizing — or holding in portfolio — about 50 percent of all U.S. mortgages.They will not be able to do this under Treasury's plan. The demands for profitability from their shareholders, coupled with the cost of their government backing, is almost certain to eliminate the pricing advantages that allowed them to dominate the housing finance market before the financial crisis.Still, their government support will allow them to earn significant profits in a different way — by taking on the risks of subprime and other high-cost mortgage loans. That business would make effective use of their government backing and — at least for a while — earn the profits that their shareholders will demand.The Treasury plan warns Fannie and Freddie that they will have to earn "less than the return on other activities" when they acquire the mortgages of "low-and-moderate-income families." But this only means that they will have to earn more on the middle-class mortgages that are the heart of the housing finance market.This is an open invitation to create another financial crisis. If we learned anything from the 2008 mortgage market collapse, it is that once a government-backed entity begins to accept mortgages with low down payments and high debt-to-income ratios, the entire market begins to shift in that direction.Middle-class homebuyers, who could otherwise afford the down payments and other terms of a prime mortgage, seek out the opportunity to buy a larger home with a low or no downpayment.Only a firm with government backing could pursue this business, but it will be a plausible profit-making activity for Fannie and Freddie once they are released from the conservatorships and free to exploit their government guarantee. In the midst of the housing boom in the early 2000s, Fannie's staff noted that 37 percent of the subprime mortgages they were acquiring — ostensibly to meet the government's affordable-housing goals — were going to homebuyers above median income.The results were clearly on view in 2008, when a collapse in the home-mortgage system brought on by the prevalence of weak and risky mortgages produced a monumental financial crisis. Fool me once, shame on you; fool me twice, shame on me.Given this potential outcome, why is the Treasury proposing this plan? There is no obvious need for a government-backed profit-making firm in today's housing finance market. FHA could assume the important role of helping low- and moderate-income families buy their first home.We would all be better off if the Federal Housing Finance Agency — the GSEs' regulator and conservator — simply decided to withdraw them gradually from the market. As their conservator, FHFA has the power to do this by reducing the size of the mortgages they are permitted to buy until they are no longer significant players in housing finance. Banks and private securitizers would then easily take their place, most likely focusing solely on prime mortgages.In that case, of course, today's speculators in Fannie and Freddie stock would be the losers, but the taxpayers and the financial markets would be saved from a major future loss.Why this hasn't already happened in a conservative administration remains an enduring mystery. Treasury's plan for releasing Fannie Mae and Freddie Mac from their conservatorships is missing only one thing: a good reason for doing it. The dangers the two companies will create for the U.S. economy will far outweigh whatever benefits Treasury sees.Under the plan, Fannie and Freddie will be fully recapitalized — probably by allowing them to keep all or a portion of their profits and by selling shares to the public. However they are recapitalized, Treasury makes clear that they will continue to be backed by the government — a benefit for which they will be required to pay.The Treasury says the purpose of their recapitalization is to protect the taxpayers in the event that the two firms fail again. But that makes little sense. The taxpayers would not have to be protected if the companies were adequately capitalized and operated without government backing.Indeed, it should have been clear by now that government backing for private profit-seeking firms is a clear and present danger to the stability of the U.S. financial system. Government support enables companies to raise virtually unlimited debt while taking financial risks that the market would routinely deny to firms that operate without it.Nor, it seems, has Treasury considered what kind of business Fannie and Freddie will likely pursue as government-backed profit-seeking firms.When Fannie and Freddie had minimal capitalization and a free but "implicit" government guarantee, profitability was easy. Most of the housing finance market was open to them, and they could set their pricing at levels others could not match. That enabled them to drive competitors out of any portion of the market that they wanted to dominate. By the early 2000s they were acquiring and securitizing — or holding in portfolio — about 50 percent of all U.S. mortgages.They will not be able to do this under Treasury's plan. The demands for profitability from their shareholders, coupled with the cost of their government backing, is almost certain to eliminate the pricing advantages that allowed them to dominate the housing finance market before the financial crisis.Still, their government support will allow them to earn significant profits in a different way — by taking on the risks of subprime and other high-cost mortgage loans. That business would make effective use of their government backing and — at least for a while — earn the profits that their shareholders will demand.The Treasury plan warns Fannie and Freddie that they will have to earn "less than the return on other activities" when they acquire the mortgages of "low-and-moderate-income families." But this only means that they will have to earn more on the middle-class mortgages that are the heart of the housing finance market.This is an open invitation to create another financial crisis. If we learned anything from the 2008 mortgage market collapse, it is that once a government-backed entity begins to accept mortgages with low down payments and high debt-to-income ratios, the entire market begins to shift in that direction.Middle-class homebuyers, who could otherwise afford the down payments and other terms of a prime mortgage, seek out the opportunity to buy a larger home with a low or no downpayment.Only a firm with government backing could pursue this business, but it will be a plausible profit-making activity for Fannie and Freddie once they are released from the conservatorships and free to exploit their government guarantee. In the midst of the housing boom in the early 2000s, Fannie's staff noted that 37 percent of the subprime mortgages they were acquiring — ostensibly to meet the government's affordable-housing goals — were going to homebuyers above median income.The results were clearly on view in 2008, when a collapse in the home-mortgage system brought on by the prevalence of weak and risky mortgages produced a monumental financial crisis. Fool me once, shame on you; fool me twice, shame on me.Given this potential outcome, why is the Treasury proposing this plan? There is no obvious need for a government-backed profit-making firm in today's housing finance market. FHA could assume the important role of helping low- and moderate-income families buy their first home.We would all be better off if the Federal Housing Finance Agency — the GSEs' regulator and conservator — simply decided to withdraw them gradually from the market. As their conservator, FHFA has the power to do this by reducing the size of the mortgages they are permitted to buy until they are no longer significant players in housing finance. Banks and private securitizers would then easily take their place, most likely focusing solely on prime mortgages.In that case, of course, today's speculators in Fannie and Freddie stock would be the losers, but the taxpayers and the financial markets would be saved from a major future loss.Why this hasn't already happened in a conservative administration remains an enduring mystery.

|

| Climate activist: Why tout development if there's no future? Posted: 26 Sep 2019 10:19 PM PDT  An Indian girl who was among the 16 young activists filing a complaint at the United Nations accusing countries of inaction on climate change has taken that step before. Ridhima Pandey, now 11, filed a petition in 2017 at India's National Green Tribunal, which oversees environmental concerns, for not taking serious enough steps to combat climate change. Pandey was among the activists including Swedish teen Greta Thunberg who criticized Germany, France, Brazil, Argentina and Turkey for failing to uphold their obligations to young people under the U.N.'s Convention on the Rights of the Child. An Indian girl who was among the 16 young activists filing a complaint at the United Nations accusing countries of inaction on climate change has taken that step before. Ridhima Pandey, now 11, filed a petition in 2017 at India's National Green Tribunal, which oversees environmental concerns, for not taking serious enough steps to combat climate change. Pandey was among the activists including Swedish teen Greta Thunberg who criticized Germany, France, Brazil, Argentina and Turkey for failing to uphold their obligations to young people under the U.N.'s Convention on the Rights of the Child.

|

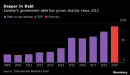

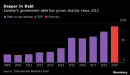

| Charts That Show The New Zambian Finance Chief’s Budget Dilemma Posted: 26 Sep 2019 01:57 AM PDT  (Bloomberg) -- Zambian Finance Minister Bwalya Ng'andu's job when presenting his maiden budget to lawmakers on Friday should be simple: he only has to show the plan for 10% of the government's spend next year.That's because about 90% is already tied up with wages and paying debts, according to President Edgar Lungu. The hard part is figuring out how to spread the meager resources, while at the same time trying to raise revenues from the key copper mining sector without choking it.Ng'andu took the post in July after Lungu fired his predecessor Margaret Mwanakatwe, and he needs to deal with a myriad of difficulties, from rising debt to fast falling foreign-exchange reserves, as these charts show:Splurging on new roads, airports and farming and energy subsidies has sent Zambia's debt skyward, along with the cost of servicing it. The International Monetary Fund warned in August that the growth in lending is unsustainable. The government is acutely aware of the financial strains caused by servicing these loans, and has repeated a pledge that it won't take on new commercial debts. It needs to stick to its word, and Ng'andu's budget will give a glimpse into how likely this is.A severe drought and the debt burden have put the brakes on Zambia's economic growth, which is now slower than population expansion for the first time this millennium. That means Zambians are getting poorer. Farm output has plunged and a power shortage is hurting almost every sector of the economy. Inflation has soared as a result, and hit an almost three-year high of 10.5% in September.Last year, Ng'andu's predecessor tried to raise much-needed revenue by ratcheting up royalties for Zambia's copper industry, the second biggest in Africa. A lobby group for companies including First Quantum Minerals Ltd.'s and Glencore Plc's local units have said this will lead to output plunging in 2019. Lower tax rates will boost government's revenues from the industry because of increased output levels, according to the group. There may be little room for Ng'andu to roll back on royalty increases. Another key question is whether the new finance minister discards Mwanakatwe's plan to replace value-added tax with a non-refundable sales tax, which mine operators have criticized strongly.The clock is ticking for Zambia to get its finances on a more sustainable path. Yields on its dollar debt have topped 20% this year as investors fret over the government's ability to repay when the first of its $3 billion in Eurobonds is due in 2022. With yields this high, refinancing, if possible, would be costly. And there's an election due in 2021, making the necessary spending cuts politically more difficult after next year.As debt-servicing costs grew, foreign-exchange reserves diminished. The IMF forecasts that Zambia's dollar holdings will cover only 1.6 months worth of imports by the end of the year. Recommended levels are about double that. Because of a relative dearth of dollars, Zambia's kwacha has weakened 10% against the greenback over the past 12 months.To contact the reporters on this story: Matthew Hill in Maputo at mhill58@bloomberg.net;Taonga Clifford Mitimingi in Lusaka at tmitimingi@bloomberg.netTo contact the editors responsible for this story: Gordon Bell at gbell16@bloomberg.net, Rene Vollgraaff, Hilton ShoneFor more articles like this, please visit us at bloomberg.com©2019 Bloomberg L.P. (Bloomberg) -- Zambian Finance Minister Bwalya Ng'andu's job when presenting his maiden budget to lawmakers on Friday should be simple: he only has to show the plan for 10% of the government's spend next year.That's because about 90% is already tied up with wages and paying debts, according to President Edgar Lungu. The hard part is figuring out how to spread the meager resources, while at the same time trying to raise revenues from the key copper mining sector without choking it.Ng'andu took the post in July after Lungu fired his predecessor Margaret Mwanakatwe, and he needs to deal with a myriad of difficulties, from rising debt to fast falling foreign-exchange reserves, as these charts show:Splurging on new roads, airports and farming and energy subsidies has sent Zambia's debt skyward, along with the cost of servicing it. The International Monetary Fund warned in August that the growth in lending is unsustainable. The government is acutely aware of the financial strains caused by servicing these loans, and has repeated a pledge that it won't take on new commercial debts. It needs to stick to its word, and Ng'andu's budget will give a glimpse into how likely this is.A severe drought and the debt burden have put the brakes on Zambia's economic growth, which is now slower than population expansion for the first time this millennium. That means Zambians are getting poorer. Farm output has plunged and a power shortage is hurting almost every sector of the economy. Inflation has soared as a result, and hit an almost three-year high of 10.5% in September.Last year, Ng'andu's predecessor tried to raise much-needed revenue by ratcheting up royalties for Zambia's copper industry, the second biggest in Africa. A lobby group for companies including First Quantum Minerals Ltd.'s and Glencore Plc's local units have said this will lead to output plunging in 2019. Lower tax rates will boost government's revenues from the industry because of increased output levels, according to the group. There may be little room for Ng'andu to roll back on royalty increases. Another key question is whether the new finance minister discards Mwanakatwe's plan to replace value-added tax with a non-refundable sales tax, which mine operators have criticized strongly.The clock is ticking for Zambia to get its finances on a more sustainable path. Yields on its dollar debt have topped 20% this year as investors fret over the government's ability to repay when the first of its $3 billion in Eurobonds is due in 2022. With yields this high, refinancing, if possible, would be costly. And there's an election due in 2021, making the necessary spending cuts politically more difficult after next year.As debt-servicing costs grew, foreign-exchange reserves diminished. The IMF forecasts that Zambia's dollar holdings will cover only 1.6 months worth of imports by the end of the year. Recommended levels are about double that. Because of a relative dearth of dollars, Zambia's kwacha has weakened 10% against the greenback over the past 12 months.To contact the reporters on this story: Matthew Hill in Maputo at mhill58@bloomberg.net;Taonga Clifford Mitimingi in Lusaka at tmitimingi@bloomberg.netTo contact the editors responsible for this story: Gordon Bell at gbell16@bloomberg.net, Rene Vollgraaff, Hilton ShoneFor more articles like this, please visit us at bloomberg.com©2019 Bloomberg L.P.

|

| NASA Didn't Find India's Missing Vikram Lander Posted: 27 Sep 2019 06:29 AM PDT  The Lunar Reconnaissance Orbiter flew over the proposed landing site, but images came up blank. The Lunar Reconnaissance Orbiter flew over the proposed landing site, but images came up blank.

|

| Borneo pygmy elephant found dead in Malaysia Posted: 27 Sep 2019 04:09 AM PDT  A pygmy elephant has been found dead in a river on the Malaysian part of Borneo island, an official said Friday, the latest of the endangered creatures to perish. There are only around 1,500 surviving Borneo pygmy elephants, a subspecies that can reach a height of up to three metres (10 feet), according to international conservation group WWF. Wildlife officials are still investigating the cause of death of the male creature, aged around 10 years, whose body was discovered floating in the water, attached by a rope to a tree on the riverbank. A pygmy elephant has been found dead in a river on the Malaysian part of Borneo island, an official said Friday, the latest of the endangered creatures to perish. There are only around 1,500 surviving Borneo pygmy elephants, a subspecies that can reach a height of up to three metres (10 feet), according to international conservation group WWF. Wildlife officials are still investigating the cause of death of the male creature, aged around 10 years, whose body was discovered floating in the water, attached by a rope to a tree on the riverbank.

|

| Melting ice is slowing down the Atlantic ocean's circulation system. Yes, that's similar to what happens in 'The Day After Tomorrow.' Posted: 26 Sep 2019 11:48 AM PDT  A new UN report found global oceans could rise 3 feet by 2100 due in part to melting ice. That melt could also slow the Atlantic ocean current system. A new UN report found global oceans could rise 3 feet by 2100 due in part to melting ice. That melt could also slow the Atlantic ocean current system.

|

| How to Invest Your Money for the Short and Long Term Posted: 26 Sep 2019 08:59 AM PDT ![How to Invest Your Money for the Short and Long Term How to Invest Your Money for the Short and Long Term]() You will find plenty of advice about which stocks are hot and how to invest money in the stock market. "We really think if you take a goals-based investment approach, that is best," says D. Keith Lockyer, investment market manager with the financial firm PNC Wealth Management. Cash for next year's vacation needs to be treated differently than cash for a retirement 20 years down the road. You will find plenty of advice about which stocks are hot and how to invest money in the stock market. "We really think if you take a goals-based investment approach, that is best," says D. Keith Lockyer, investment market manager with the financial firm PNC Wealth Management. Cash for next year's vacation needs to be treated differently than cash for a retirement 20 years down the road.

|

| Vehicles With the Best Combination of Fuel Economy and Acceleration Posted: 27 Sep 2019 09:39 AM PDT  Consumer Reports' tests show that drivers don't have to give up engine performance in exchange for good fuel economy. We compiled this list of vehicles that provided the best combination of fuel ... Consumer Reports' tests show that drivers don't have to give up engine performance in exchange for good fuel economy. We compiled this list of vehicles that provided the best combination of fuel ...

|

| Caught in the act: a black hole rips apart an unfortunate star Posted: 26 Sep 2019 12:34 PM PDT ![Caught in the act: a black hole rips apart an unfortunate star Caught in the act: a black hole rips apart an unfortunate star]() Scientists have captured a view of a colossal black hole violently ripping apart a doomed star, illustrating a extraordinary and chaotic cosmic event from beginning to end for the first time using NASA's planet-hunting telescope. The U.S. space agency's orbiting Transiting Exoplanet Survey Satellite, better known as TESS, revealed the detailed timeline of a star 375 million light-years away warping and spiraling into the unrelenting gravitational pull of a supermassive black hole, researchers said on Thursday. The star, roughly the same size as our sun, was eventually sucked into oblivion in a rare cosmic occurrence that astronomers call a tidal disruption event, they added. Scientists have captured a view of a colossal black hole violently ripping apart a doomed star, illustrating a extraordinary and chaotic cosmic event from beginning to end for the first time using NASA's planet-hunting telescope. The U.S. space agency's orbiting Transiting Exoplanet Survey Satellite, better known as TESS, revealed the detailed timeline of a star 375 million light-years away warping and spiraling into the unrelenting gravitational pull of a supermassive black hole, researchers said on Thursday. The star, roughly the same size as our sun, was eventually sucked into oblivion in a rare cosmic occurrence that astronomers call a tidal disruption event, they added.

|

| The U.S. Gets Its First Electric-Only Gas Station Posted: 27 Sep 2019 10:54 AM PDT  It's not an oxymoron. It's infrastructure. It's not an oxymoron. It's infrastructure.

|

| Mexico Central Bank Seen Cutting to Catch Up: Decision Day Guide Posted: 26 Sep 2019 04:00 AM PDT  (Bloomberg) -- After years of maintaining some of the world's tightest money, Mexico's central bank is a late arrival at the global easing party. Now investors want to know how enthusiastically it will join in.Most forecasters say the bank will stick with incremental steps Thursday -- lowering the benchmark interest rate by a quarter-point for a second straight month, to 7.75%.But with inflation at a three-year low, the economy near recession and real rates among the world's highest, analysts from BNP Paribas and Goldman Sachs Group Inc. are among those who suggest a more aggressive move is possible."The discussion is around what type of cuts they're going to do -- gradually by 25 points at a time, or a more front-loaded approach," said Joel Virgen, chief Mexico economist at BNP, who expects a half-point reduction.Inflation slowed to meet the bank's 3% target this month. It's likely to stay around that level for a while before picking up again in 2020, Virgen said, "so the window is open for the rest of this year."MEXICO INSIGHT: Global Uncertainty, Domestic Demand Limit GrowthMexico's policy makers may also give some guidance Thursday as to whether they see themselves in a cutting cycle, language the central bank avoided when it lowered interest rates last month for the first time in five years. Economists expect the rate to be 7% by the end of next year.Even with a half-point cut, the benchmark would still be near a 10-year high -- and Mexico would still be a global outlier.It currently has the second-highest real interest rate (the gap between the policy rate and inflation) among the world's biggest economies, exceeded only by crisis-stricken Argentina.If Banxico does surprise with a bigger-than-expected cut, it would mark a departure from the past several years.The bank raised interest rates more than any of its G-20 peers after the Federal Reserve began hiking in 2015 –- worried that the peso could plunge without a generous cushion.Even so, the currency took a hit of some 15%, driving inflation to the highest level in years, as newly elected President Donald Trump's belligerence toward Mexico alarmed investors.Concern about the peso's fragility hasn't disappeared, but the case for tight money is weakening as the economy slows. Analysts expect growth of just 0.5% this year, the lowest in a decade.One reason the central bank may be hesitant about a bigger cut is core inflation, which excludes food and energy. That hasn't come down as much as headline prices.There are also uncertainties stemming from trade tensions abroad, and President Andres Manuel Lopez Obrador's policies at home. Banxico has blamed both for holding back investment.Still, low growth, slowing inflation and an easing Fed -- as well as rate cuts in regional countries like Brazil and Chile -- are aligning to allow for a half-point reduction, according to BBVA Bancomer analysts including Ociel Hernandez."Banxico has room to deliver a bolder cut," they wrote. "The question is whether the board is ready to speed up the cycle or not."To contact the reporter on this story: Eric Martin in Mexico City at emartin21@bloomberg.netTo contact the editors responsible for this story: Juan Pablo Spinetto at jspinetto@bloomberg.net, Ben Holland, Robert JamesonFor more articles like this, please visit us at bloomberg.com©2019 Bloomberg L.P. (Bloomberg) -- After years of maintaining some of the world's tightest money, Mexico's central bank is a late arrival at the global easing party. Now investors want to know how enthusiastically it will join in.Most forecasters say the bank will stick with incremental steps Thursday -- lowering the benchmark interest rate by a quarter-point for a second straight month, to 7.75%.But with inflation at a three-year low, the economy near recession and real rates among the world's highest, analysts from BNP Paribas and Goldman Sachs Group Inc. are among those who suggest a more aggressive move is possible."The discussion is around what type of cuts they're going to do -- gradually by 25 points at a time, or a more front-loaded approach," said Joel Virgen, chief Mexico economist at BNP, who expects a half-point reduction.Inflation slowed to meet the bank's 3% target this month. It's likely to stay around that level for a while before picking up again in 2020, Virgen said, "so the window is open for the rest of this year."MEXICO INSIGHT: Global Uncertainty, Domestic Demand Limit GrowthMexico's policy makers may also give some guidance Thursday as to whether they see themselves in a cutting cycle, language the central bank avoided when it lowered interest rates last month for the first time in five years. Economists expect the rate to be 7% by the end of next year.Even with a half-point cut, the benchmark would still be near a 10-year high -- and Mexico would still be a global outlier.It currently has the second-highest real interest rate (the gap between the policy rate and inflation) among the world's biggest economies, exceeded only by crisis-stricken Argentina.If Banxico does surprise with a bigger-than-expected cut, it would mark a departure from the past several years.The bank raised interest rates more than any of its G-20 peers after the Federal Reserve began hiking in 2015 –- worried that the peso could plunge without a generous cushion.Even so, the currency took a hit of some 15%, driving inflation to the highest level in years, as newly elected President Donald Trump's belligerence toward Mexico alarmed investors.Concern about the peso's fragility hasn't disappeared, but the case for tight money is weakening as the economy slows. Analysts expect growth of just 0.5% this year, the lowest in a decade.One reason the central bank may be hesitant about a bigger cut is core inflation, which excludes food and energy. That hasn't come down as much as headline prices.There are also uncertainties stemming from trade tensions abroad, and President Andres Manuel Lopez Obrador's policies at home. Banxico has blamed both for holding back investment.Still, low growth, slowing inflation and an easing Fed -- as well as rate cuts in regional countries like Brazil and Chile -- are aligning to allow for a half-point reduction, according to BBVA Bancomer analysts including Ociel Hernandez."Banxico has room to deliver a bolder cut," they wrote. "The question is whether the board is ready to speed up the cycle or not."To contact the reporter on this story: Eric Martin in Mexico City at emartin21@bloomberg.netTo contact the editors responsible for this story: Juan Pablo Spinetto at jspinetto@bloomberg.net, Ben Holland, Robert JamesonFor more articles like this, please visit us at bloomberg.com©2019 Bloomberg L.P.

|

| Florence: What you need to know in graphics Posted: 25 Sep 2019 10:37 PM PDT  Expected path, rainfall and who is at risk from the storm Expected path, rainfall and who is at risk from the storm

|

| The T. Rex had the strongest bite of any land animal ever — and new research shows the dinosaur really could crush a car Posted: 27 Sep 2019 06:46 AM PDT  Scientists have discovered that T. rexes had rigid skulls, which enabled the dinosaurs to have the strongest bite force of any land animal on Earth. Scientists have discovered that T. rexes had rigid skulls, which enabled the dinosaurs to have the strongest bite force of any land animal on Earth.

|

| Climate change is really about prosperity, peace, public health and posterity – not saving the environment Posted: 27 Sep 2019 04:18 AM PDT ![Climate change is really about prosperity, peace, public health and posterity – not saving the environment Climate change is really about prosperity, peace, public health and posterity – not saving the environment]() Many people believe anthropogenic climate change – rapid and far-reaching shifts in the climate caused by human activity – is now the story that will define the 21st century, whether anyone's good at telling it or not. The past decade has witnessed an explosion of climate change communication efforts spanning nearly every conceivable medium, channel and messenger. Documentaries, popular books and articles, interactive websites, immersive virtual reality, community events — all are being used in increasingly creative ways to communicate the story of climate change. Many people believe anthropogenic climate change – rapid and far-reaching shifts in the climate caused by human activity – is now the story that will define the 21st century, whether anyone's good at telling it or not. The past decade has witnessed an explosion of climate change communication efforts spanning nearly every conceivable medium, channel and messenger. Documentaries, popular books and articles, interactive websites, immersive virtual reality, community events — all are being used in increasingly creative ways to communicate the story of climate change.

|

| Scientists discover oldest galaxy cluster Posted: 26 Sep 2019 05:21 PM PDT  Astronomers have discovered a 13-billion-year-old galaxy cluster that is the earliest ever observed, according to a paper released Friday, a finding that may hold clues about how the universe developed. Such an early-stage cluster -- called a protocluster -- is "not easy to find", Yuichi Harikane, a researcher at the National Astronomical Observatory of Japan who led the international team, said in a press release. "A protocluster is a rare and special system with an extremely high density," Harikane said, adding that the researchers used the wide viewing field of the Subaru telescope in Hawaii to "map a large area of the sky" in their search. Astronomers have discovered a 13-billion-year-old galaxy cluster that is the earliest ever observed, according to a paper released Friday, a finding that may hold clues about how the universe developed. Such an early-stage cluster -- called a protocluster -- is "not easy to find", Yuichi Harikane, a researcher at the National Astronomical Observatory of Japan who led the international team, said in a press release. "A protocluster is a rare and special system with an extremely high density," Harikane said, adding that the researchers used the wide viewing field of the Subaru telescope in Hawaii to "map a large area of the sky" in their search.

|

| Vanguard Versus Fidelity: Which is Best for You? Posted: 26 Sep 2019 08:36 AM PDT ![Vanguard Versus Fidelity: Which is Best for You? Vanguard Versus Fidelity: Which is Best for You?]() As investors look for a home for their money, many of them may choose between Vanguard or Fidelity Investments, two mutual fund industry giants. There are other investment firms, such as T. Rowe Price, BlackRock, Charles Schwab and others, but Vanguard and Fidelity are two of the oldest firms around and even for non-investment people may be the best known. As investors look for a home for their money, many of them may choose between Vanguard or Fidelity Investments, two mutual fund industry giants. There are other investment firms, such as T. Rowe Price, BlackRock, Charles Schwab and others, but Vanguard and Fidelity are two of the oldest firms around and even for non-investment people may be the best known.

|

| How retirees can check if they're having enough taxes withheld Posted: 26 Sep 2019 08:08 AM PDT  The risk of having too little set aside for income taxes applies to both workers — and retirees. A new IRS withholding tool online can help both. The risk of having too little set aside for income taxes applies to both workers — and retirees. A new IRS withholding tool online can help both.

|

| Scientists puzzled by really big planet orbiting really little star Posted: 26 Sep 2019 03:37 PM PDT  Scientists are expressing surprise after discovering a solar system 30 light-years away from Earth that defies current understanding about planet formation, with a large Jupiter-like planet orbiting a diminutive star known as a red dwarf. The star, called GJ 3512, is about 12% the size of our sun, while the planet that orbits it has a mass of at least about half of Jupiter, our solar system's largest planet. "Yes, an absolute surprise," said astrophysicist Juan Carlos Morales of the Institute of Space Studies of Catalonia at the Institute of Space Sciences in Spain, who led the research published in the journal Science. Scientists are expressing surprise after discovering a solar system 30 light-years away from Earth that defies current understanding about planet formation, with a large Jupiter-like planet orbiting a diminutive star known as a red dwarf. The star, called GJ 3512, is about 12% the size of our sun, while the planet that orbits it has a mass of at least about half of Jupiter, our solar system's largest planet. "Yes, an absolute surprise," said astrophysicist Juan Carlos Morales of the Institute of Space Studies of Catalonia at the Institute of Space Sciences in Spain, who led the research published in the journal Science.

|

| Don't let your guard down: Hurricane season 2019 has hit some records. And it's not over yet Posted: 27 Sep 2019 01:08 PM PDT  We're still in the middle of hurricane season 2019, and that means coastal residents should stay prepared for possible more record-breaking storms We're still in the middle of hurricane season 2019, and that means coastal residents should stay prepared for possible more record-breaking storms

|

| Argentina’s Fernandez Hints at Uruguay-Style Debt Solution Posted: 26 Sep 2019 02:58 PM PDT  (Bloomberg) -- Presidential candidate Alberto Fernandez indicated he would tackle Argentina's debt problem by adopting a strategy similar to that of Uruguay, which successfully extended its bond maturities in 2003."It's not going to be that difficult to do something similar to what Uruguay did," Fernandez said at a business conference in Cordoba, Argentina, adding that the goal would be to buy time to repay the debt without imposing a haircut to investors. "I've spoken to many investment funds and they're aware that that can be a way out."In a broad outline of his economic agenda, the Argentine front-runner said that the country needs to lower interest rates and that currency controls are not the solution to developing the economy, but a transitory measure. He added that, under current conditions, Argentina can't repay its debt."We have never said there would be a haircut," Fernandez said. "What we say to bondholders is that we need to grow to pay. If not, there is no way to pay."Uruguay is often cited as a successful case of debt reprofiling in emerging markets. Without changing coupons, the government succeeded in launching a voluntary debt exchange that lengthened debt maturities on 18 international bonds. An overwhelming majority of creditors accepted the terms of the new bonds, avoiding a default while Uruguay's economy recovered.What Our Economist Says"Fernandez's hint at a Uruguay-like reprofiling makes sense and is good news in that it signals that he aims at a negotiated reprofiling. What is unsettling is that his argument that the country needs to lower rates and export more says very little about his plans to fight inflation."\-- Adriana Dupita, Latin America economist, Bloomberg EconomicsFernandez defeated President Mauricio Macri in an Aug. 11 primary vote by a wider-than-expected margin. The Argentine currency and bonds have since sold off as investors priced in larger chances of default in the coming years. Argentina holds presidential elections on Oct. 27.Fernandez emphasized that boosting exports and consumption in Argentina are critical, and that one doesn't have to be chosen over the other. He also considers Macri's current reprofiling proposal to be the same as a default."They call it reprofiling but what they're saying is they can't pay," Fernandez said. "In other times, it was called default."(Adds comment from Bloomberg economist, additional remarks from Fernandez)To contact the reporters on this story: Patrick Gillespie in Buenos Aires at pgillespie29@bloomberg.net;Jorgelina do Rosario in Buenos Aires at jdorosario@bloomberg.netTo contact the editors responsible for this story: Juan Pablo Spinetto at jspinetto@bloomberg.net, Walter BrandimarteFor more articles like this, please visit us at bloomberg.com©2019 Bloomberg L.P. (Bloomberg) -- Presidential candidate Alberto Fernandez indicated he would tackle Argentina's debt problem by adopting a strategy similar to that of Uruguay, which successfully extended its bond maturities in 2003."It's not going to be that difficult to do something similar to what Uruguay did," Fernandez said at a business conference in Cordoba, Argentina, adding that the goal would be to buy time to repay the debt without imposing a haircut to investors. "I've spoken to many investment funds and they're aware that that can be a way out."In a broad outline of his economic agenda, the Argentine front-runner said that the country needs to lower interest rates and that currency controls are not the solution to developing the economy, but a transitory measure. He added that, under current conditions, Argentina can't repay its debt."We have never said there would be a haircut," Fernandez said. "What we say to bondholders is that we need to grow to pay. If not, there is no way to pay."Uruguay is often cited as a successful case of debt reprofiling in emerging markets. Without changing coupons, the government succeeded in launching a voluntary debt exchange that lengthened debt maturities on 18 international bonds. An overwhelming majority of creditors accepted the terms of the new bonds, avoiding a default while Uruguay's economy recovered.What Our Economist Says"Fernandez's hint at a Uruguay-like reprofiling makes sense and is good news in that it signals that he aims at a negotiated reprofiling. What is unsettling is that his argument that the country needs to lower rates and export more says very little about his plans to fight inflation."\-- Adriana Dupita, Latin America economist, Bloomberg EconomicsFernandez defeated President Mauricio Macri in an Aug. 11 primary vote by a wider-than-expected margin. The Argentine currency and bonds have since sold off as investors priced in larger chances of default in the coming years. Argentina holds presidential elections on Oct. 27.Fernandez emphasized that boosting exports and consumption in Argentina are critical, and that one doesn't have to be chosen over the other. He also considers Macri's current reprofiling proposal to be the same as a default."They call it reprofiling but what they're saying is they can't pay," Fernandez said. "In other times, it was called default."(Adds comment from Bloomberg economist, additional remarks from Fernandez)To contact the reporters on this story: Patrick Gillespie in Buenos Aires at pgillespie29@bloomberg.net;Jorgelina do Rosario in Buenos Aires at jdorosario@bloomberg.netTo contact the editors responsible for this story: Juan Pablo Spinetto at jspinetto@bloomberg.net, Walter BrandimarteFor more articles like this, please visit us at bloomberg.com©2019 Bloomberg L.P.

|

| NASA's future missions will explore an icy moon of Jupiter, collect samples on Mars, and more. Here's what's coming in the next 10 years. Posted: 26 Sep 2019 12:25 PM PDT  NASA intends to return to the moon, continue on to Mars, and look for life near Saturn and Jupiter within 10 years. Its other plans go even further. NASA intends to return to the moon, continue on to Mars, and look for life near Saturn and Jupiter within 10 years. Its other plans go even further.

|

| Millennials: Go ahead and take that vacation instead of paying off your student debt. Posted: 27 Sep 2019 02:36 PM PDT  What kind of personal finance author would I be if my husband and I went on a fancy honeymoon instead of paying off his student debt? What kind of personal finance author would I be if my husband and I went on a fancy honeymoon instead of paying off his student debt?

|

0 条评论:

发表评论

订阅 博文评论 [Atom]

<< 主页